Best Legal Funding Platforms: 2025 Roundup

The legal funding industry in 2025 is evolving quickly, driven by AI, stricter regulations, and changing client demands. Platforms now focus on combining advanced technology with compliance to meet the needs of attorneys, law firms, and clients. Key trends include:

AI Integration: 79% of law firms use AI, saving time and boosting productivity. Predictive analytics helps funders assess case risks and outcomes.

Regulatory Changes: Laws like the Corporate Transparency Act and Georgia's SB 69 demand more transparency and stricter compliance in funding agreements.

Digital Platforms: Tools like Giupedi streamline funding by connecting hospitals, attorneys, and patients, offering HIPAA-compliant data sharing and faster case evaluations.

Giupedi stands out with its AI-driven approach, helping hospitals recover revenue while simplifying legal client acquisition. It integrates directly with hospital systems, reduces intake costs, and ensures secure, patient-controlled data sharing. With the global litigation funding market projected to grow to $37.5 billion by 2028, platforms like Giupedi are reshaping the industry.

Legal Funding Trends for 2025

The legal funding industry is experiencing major shifts in 2025, driven by advancements in technology, evolving regulations, and changing client demands. These developments are reshaping how law firms, clients, and funding platforms operate, with a strong focus on leveraging technology and adhering to stricter compliance standards.

AI and Automation

Artificial intelligence (AI) is at the forefront of transforming legal workflows. Today, 79% of law firms have incorporated AI tools into their operations[3], and 85% of lawyers report using generative AI on a daily or weekly basis[4]. These tools are saving attorneys between one and five hours per week, with some estimating this translates into $100,000 in additional billable time annually[2][4]. From faster case evaluations to enhanced risk assessments, AI is streamlining processes and improving productivity.

"AI will not replace lawyers - it will empower them to focus on strategy, advocacy, and negotiation by handling the routine and repetitive." - Paul Gaskell, Chief Technology Officer, Avantia Law[5]

AI systems are also revolutionizing data management, enabling quicker responses to clients and reducing errors[2]. Predictive analytics, in particular, are helping funding platforms make smarter decisions by analyzing data on past cases, judicial behavior, and opposing counsel strategies[3]. Looking ahead, 77% of legal professionals believe AI will have a significant impact on their work, while 72% view it as a positive force in the industry[2]. However, as AI enhances efficiency, legal regulations are demanding greater transparency and stricter compliance.

Compliance and Transparency Requirements

The regulatory landscape for legal funding in 2025 has become more complex. The Corporate Transparency Act (CTA) now mandates the disclosure of beneficial ownership details to prevent illegal activities, affecting LLCs, corporations, and other registered entities in the U.S.[7]. Penalties for non-compliance include daily civil fines and potential criminal charges[7].

Georgia has introduced the "Georgia Courts Access and Consumer Protection Act" (SB 69), which takes a firm stance on litigation funding. This law requires all individuals or entities involved in litigation funding within the state to register with the Department of Banking and Finance. Registrants must disclose ownership structures, employment histories, and even the criminal records of key personnel over the past decade. Additionally, foreign ownership or investment ties are strictly prohibited. These provisions, which include discoverability of funding agreements over $25,000, will largely take effect by January 1, 2026[8]. Regulatory bodies are also increasingly relying on consumer complaints to identify potential fair lending violations[9]. While compliance requirements grow more stringent, digital tools are reshaping how funding is accessed and managed.

Digital-First Client Platforms

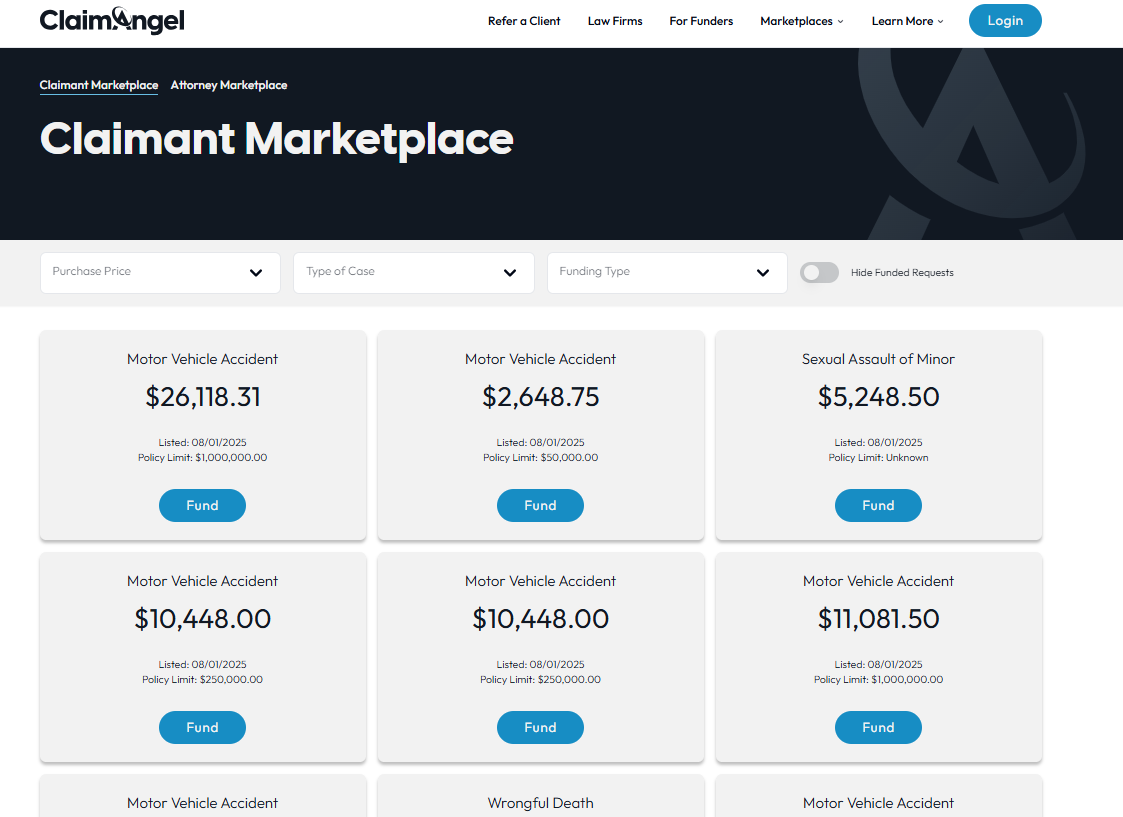

Digital platforms are revolutionizing the legal funding process, offering real-time access to resources and simplifying the funding journey. In 2024, a leading digital marketplace successfully connected over 140 law firms with more than 10 pre-vetted funding providers[11]. This approach gives attorneys a streamlined way to secure funding while offering claimants transparent terms and repayment options.

"The first and only legal funding marketplace where funders deploy capital, attorneys protect and people win." - ClaimAngel[11]

The efficiency gains are clear: 61% of respondents reported moderate improvements in efficiency due to AI adoption, while 21% noted significant enhancements[6]. These digital-first solutions are paving the way for a more efficient and accessible legal funding ecosystem, setting a new standard for transparency and ease of use.

Giupedi: AI-Powered Legal Funding Platform

Giupedi is an AI-driven platform designed to connect hospitals, attorneys, and patients, aiming to recover hospital revenue and offer qualified legal representation following accidents or injuries. Legal Funding is a natural fit for Giupedi.

Core Features and How They Work

Giupedi seamlessly integrates legal referrals into the discharge process for emergency rooms and urgent care facilities. Patients can scan a QR code during discharge to securely opt in and share their medical records with attorneys. This process complies with HIPAA regulations while ensuring patients retain control over their data [12].

The platform uses AI to summarize case details by processing PDFs and electronic health records (EHR). It generates anonymized case abstracts, giving attorneys a clear overview of cases without the usual intake hurdles or high screening costs [12]. Combining legal and medical data, Giupedi creates what it terms "Ultra Qualified Leads", offering attorneys highly detailed and actionable information [14].

Another standout feature is its bidding marketplace, where law firms compete for leads. Hospitals benefit financially from this setup, as a portion of the revenue is returned to them. This creates a sustainable income stream for healthcare providers while ensuring competitive legal service pricing for patients [12].

These features are tailored to meet the specific needs of hospitals, attorneys, and patients, as described below.

How Giupedi Supports Hospitals, Attorneys, and Patients

By leveraging its core functionalities, Giupedi delivers distinct advantages to each of its stakeholders.

Hospitals gain a new avenue to recover revenue through subrogation and medical liens, all without endorsing specific attorneys. This is particularly valuable for addressing the financial strain of treating uninsured accident victims. The platform helps healthcare systems offset losses, including an estimated 10–15% revenue shortfall from Medicaid cuts by 2028 [15].

Attorneys benefit from receiving HIPAA-compliant leads paired with detailed case summaries. This streamlined process reduces intake time and costs, allowing legal professionals to make quicker, more informed decisions on case viability [12][14]. Integration with hospital systems also provides real-time access to medical data and AI-driven case triage, enhancing case matching and outcomes [13].

For patients, Giupedi offers a secure and anonymous way to connect with multiple attorneys while maintaining full control over their personal information. Generative AI tools help clients make informed decisions when selecting legal representation [11]. Additionally, through API integration, the platform can provide access to healthcare claims in as little as 30 seconds, significantly speeding up the legal funding process [16].

Platform Features Comparison

Giupedi stands out in the legal funding space, offering faster, more integrated, and compliant solutions compared to traditional manual methods.

Giupedi's AI-powered platform transforms legal client acquisition by automating record processing, reducing intake times from days to just minutes, and significantly cutting operational costs. Unlike traditional systems, it integrates HIPAA compliance directly into its framework, ensuring secure data sharing with patient control - no extra steps required.

The platform’s pricing model stands out, too. By combining a $500 annual base fee with revenue-sharing, Giupedi creates a more accessible and cost-efficient funding ecosystem. This approach benefits healthcare providers by recovering previously lost revenue while offering patients access to qualified legal representation without additional costs.

"Legal finance is a burgeoning asset class that is generally uncorrelated with the broader capital markets and macro-economic backdrop", says Chad Clamage, VPC Principal [18].

This insight highlights the growing complexity and opportunity within legal funding, a sector supported by the U.S.'s estimated $445 billion annual legal spend [18]. Giupedi’s strategic focus on hospital partnerships positions it to tap into this market effectively.

Specializing in areas like Personal Injury, Document Automation, and Data Visualization, Giupedi strengthens its foothold in the industry. Its advanced generative AI tools empower clients by guiding them through attorney selection, offering more than just a basic matching service. By equipping users with intelligent, decision-making support, the platform enhances access to justice.

Research underscores the importance of these features. A 2017 Lake Whillans study revealed that 84.29% of litigators who previously used funding would do so again [17]. This demonstrates how Giupedi’s approach aligns with modern legal funding trends and client needs.

Legal Funding Industry Outlook for 2025

The legal funding industry is on the brink of remarkable growth and transformation as it heads into 2025. With projections estimating the global litigation funding market will reach $37.5 billion by 2028 [10], the sector is poised for a mix of opportunities and challenges that will redefine how legal financing is approached by law firms and clients alike.

Changing Regulatory Environment

Regulations surrounding legal funding are shifting rapidly at both federal and state levels. In 2024, states like Louisiana, Indiana, and West Virginia enacted laws requiring limited disclosure of litigation funding arrangements [19]. This push for transparency reflects a larger, nationwide trend. Advocates for disclosure are now focusing on legislative reforms, a strategy that has already gained traction. For instance, the US Judicial Conference's Advisory Committee on Civil Rules agreed in 2024 to explore the possibility of creating disclosure rules for litigation funding [19].

Federal oversight is also tightening, building on earlier state-level changes. The emphasis on transparency and consumer protection is reshaping the industry. Many states have introduced regulations aimed at safeguarding consumers and mandating disclosure requirements [1]. Law firms are now expected to ensure clients are informed of potential conflicts, provide independent advice on funding arrangements, and maintain transparency in their dealings [1]. These shifts are setting the stage for further advancements fueled by regulatory changes and market dynamics.

Future Trends

Beyond regulation, technology is playing a pivotal role in reshaping legal funding. AI tools are streamlining operations by analyzing large volumes of claims, spotting patterns, flagging duplicate cases, and prioritizing the most promising ones [10]. This allows funders to allocate resources more effectively, cutting down on time-intensive manual processes [10].

Specialization is another emerging trend. As litigation budgets grow and the political landscape evolves, funders are increasingly focusing on larger, more traditional claims [19]. ESG considerations are also becoming a priority in investment strategies, reflecting a shift toward more socially responsible funding practices [10]. Additionally, secondary transactions are gaining traction, offering funders and clients greater liquidity and flexibility in pricing [19]. These transactions open up new ways to manage risk and optimize funding arrangements.

Looking ahead, the litigation funding market is expected to hit $67.2 billion by 2030, with an annual growth rate of 11.1% starting in 2025 [20]. This steady expansion highlights the sector's resilience and its growing importance within the legal ecosystem.

As the industry evolves, the convergence of regulatory reforms, technological advancements, and market specialization is paving the way for a more transparent and efficient legal funding environment. Firms and clients that embrace these changes while adhering to ethical practices will be best positioned to thrive. Success will depend on striking a balance between leveraging AI-driven innovations and preserving the human expertise that underpins quality legal representation. The shift toward greater transparency and specialization promises to create stronger, more ethical, and predictable funding relationships for all stakeholders involved.

Conclusion

The legal funding landscape in 2025 is undergoing a fast-paced transformation, driven by advancements in AI, clearer regulations, and the emergence of specialized platforms. Staying ahead in this environment requires a commitment to both innovation and ethical practices.

Giupedi is leading this charge, using Generative AI to address the $17.7 billion hospital revenue shortfall[15] while simplifying the process of legal client acquisition. By helping hospitals potentially recover 10–15% of revenue lost to Medicaid cuts by 2028[15], Giupedi showcases how AI-driven solutions can deliver meaningful outcomes for healthcare providers, patients, and legal professionals alike. This approach highlights a smart and strategic use of technology.

The industry is clearly shifting toward digital-first platforms that prioritize transparency and empower clients. Giupedi’s leadership reflects this trend, as Edward Bukstel, CEO of Giupedi, explains the evolving role of AI in legal tech:

"I believe we are going to see more activity like this as law firms use AI technology to shore up internal workflows as well as using AI functions to extend their reach with clients and customers. Buying the actual legal technology allows the law firms to monetize the fact that AIs tend to get smarter with use." [21]

Regulatory efforts focusing on disclosure and consumer protection are not stifling progress - they are encouraging innovation that aligns with compliance and transparency. For attorneys, hospitals, and clients navigating the complexities of legal funding in 2025, platforms that combine advanced AI with proven results are indispensable. Giupedi’s integration of hospital operations with legal client intake processes is a prime example of how longstanding challenges can be transformed into opportunities that benefit everyone involved.

The future belongs to platforms that can deliver real, measurable results while maintaining strict compliance and prioritizing client needs.

FAQs

How is AI changing the legal funding industry in 2025, and what advantages does it bring to law firms and clients?

In 2025, AI is transforming the legal funding industry by taking over tedious tasks like drafting documents and analyzing data. This shift allows law firms to save time, cut down on costs, and dedicate more energy to achieving favorable results for their clients.

AI also speeds up decision-making by simplifying workflows and offering easier access to critical information. For clients, this translates to faster and more affordable funding options during legal cases, making the entire process smoother and more manageable for everyone involved.

What major regulatory changes are shaping legal funding platforms in 2025, and how do they affect compliance and transparency?

In 2025, legal funding platforms are adapting to significant regulatory changes, including stricter enforcement of the Corporate Transparency Act (CTA) and updated anti-money laundering (AML) laws. These regulations are focused on improving transparency and curbing illegal activities, pushing platforms to implement stronger compliance systems and more detailed reporting processes.

While enforcement of the CTA faced a temporary pause earlier in the year, the broader regulatory landscape continues to trend toward increased oversight. Legal funding platforms now need to prioritize meeting these standards to stay compliant, safeguard their reputation, and avoid legal penalties. These changes aim to create a safer and more transparent funding system for legal professionals and their clients alike.

How does Giupedi help hospitals, attorneys, and patients navigate the legal funding process, and what makes it stand out from traditional methods?

Giupedi takes the hassle out of the legal funding process for hospitals, attorneys, and patients by leveraging AI and data science. This technology helps analyze client details, making it easier to connect the dots for cases involving personal injury, workers' compensation, and medical malpractice. With its secure and user-friendly platform, clients can anonymously select legal and medical providers, as well as funding options, all in one place.

What truly makes Giupedi stand out is its AI-powered matching system, which not only helps attract more clients but also aids hospitals in recovering revenue lost due to Medicaid cuts. By integrating healthcare finance with legal technology, Giupedi offers a system where everyone benefits, transforming legal funding into a solution with a meaningful social impact.